nebraska sales tax rate 2020

Nebraska Department of Revenue. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

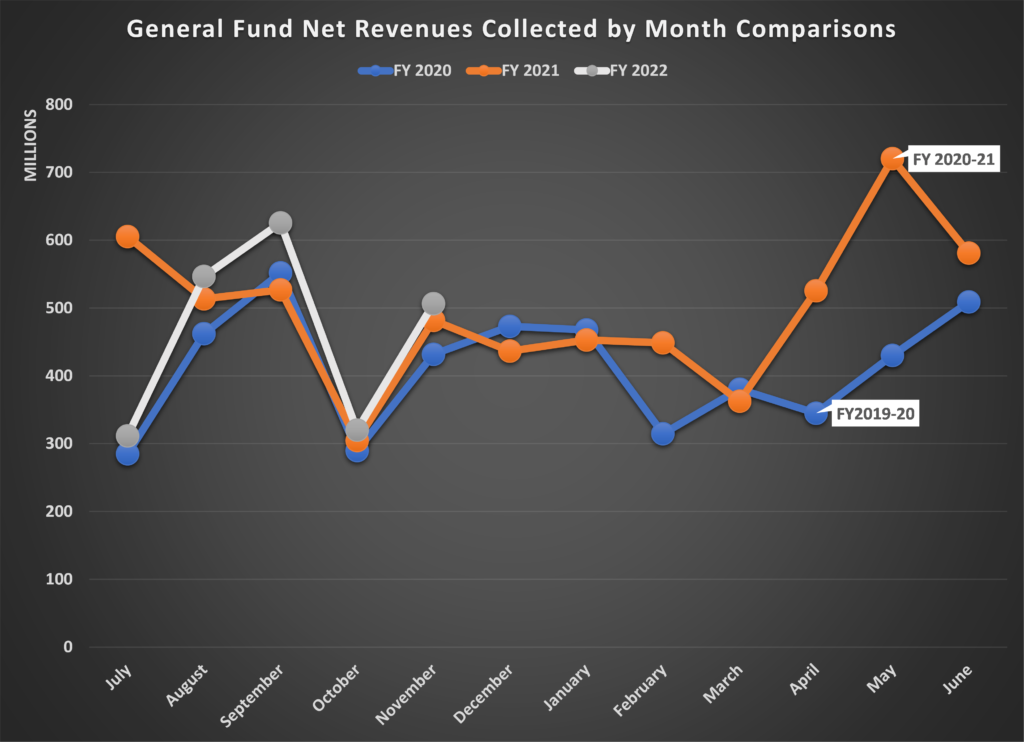

General Fund Receipts Nebraska Department Of Revenue

This rate includes any state county city and local sales taxes.

. The Nebraska NE state sales tax rate is currently 55. Groceries are exempt from the Omaha and Nebraska state sales taxes. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. The current total local sales tax rate in Omaha NE is 7000. The Nebraska sales tax rate is 55 as of 2022 with some cities and counties adding a local sales tax on top of the NE state sales tax.

The December 2020 total local sales tax rate was also 7250. Exemptions to the Nebraska sales tax will vary by state. See the County Sales and Use Tax Rates.

Tax Rate Starting Price. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you. Learn about new tax laws some long-term effects of recent events industry updates.

Nebraska Sales and Use Tax The Nebraska state sales and use tax rate is 55 055. Learn about new tax laws some long-term effects of recent events industry updates. Waste Reduction and Recycling Fee.

The latest sales tax rate for Lincoln NE. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Local Sales and Use Tax Rates Effective January 1 2020 Dakota County and Gage County each impose a tax rate of 05.

Raised from 55 to 6. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825. 800-742-7474 NE and IA.

Sales Tax Rate s c l sr. The minimum combined 2022 sales tax rate for Omaha Nebraska is. The minimum combined 2022 sales tax rate for Nebraska City Nebraska is.

This is the total of state county and city sales tax rates. Ad Get tax compliance information for the US. The state sales tax rate in.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. 31 rows Nebraska NE Sales Tax Rates by City. 536 rows Nebraska Sales Tax55.

Average Sales Tax With Local. FilePay Your Return. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective.

Sales Tax Rate Finder. So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from.

What is the sales tax rate in Omaha Nebraska. Simplify Nebraska sales tax compliance. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

And around the globe from Avalara experts. See the County Sales and Use Tax Rates section. See the County Sales and Use Tax Rates section at the.

2020 rates included for use while preparing your income tax deduction. What is the sales tax rate in Nebraska City Nebraska. And around the globe from Avalara experts.

Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05. This is the total of state county and city sales tax rates. NOVEMBER 27 2019 LINCOLN NEB Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates as of January 1 2020.

Nebraska has a statewide sales tax rate of 55 which has been in place since 1967. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. Ad Get tax compliance information for the US.

Sales and Use Taxes. The Nebraska state sales and use tax rate is 55 055. The December 2020 total local sales tax rate was also 7000.

Ebay Sales Tax A Complete Guide For Sellers Taxhack Accounting

Nebraska Drops To 35th In National Tax Ranking

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The States Where People Are Burdened With The Highest Taxes Zippia

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Compared To Rivals Nebraska Takes More From Taxpayers

Sales Tax By State Is Saas Taxable Taxjar

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

This Time It S Personal Nebraska S Personal Property Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Where S My Nebraska State Tax Refund Taxact Blog

How High Are Cell Phone Taxes In Your State Tax Foundation

2020 Nebraska Property Tax Issues Agricultural Economics

Compared To Rivals Nebraska Takes More From Taxpayers

Nebraska Income Tax Brackets 2020